ASKevin!

Good judgement is based on experience and experience is based on bad judgement!

‘AsKevin’ about the year ‘1986’ and he will tell you that it was the year with pride, that he founded his own stainless steel business and it was also the year that Sir Kenneth Cork founded the Insolvency Act 1986 (as amended).

This insolvency baron was commissioned by the Labour Government in 1977 to modernise and reform the UK insolvency law.

Soon after starting his own business, Priority Stainless Ltd, Kevin was on course to cross swords with the baron of the Insolvency Act 1986?

Cork’s firm was Coopers & Lybrand and as a result of that conflict, the whole weight of the insolvency industry descended on Kevin’s shoulders and that resulted in a considerable injustice and an inequality of arms before the British courts.

Sir Kenneth Russell Cork (1913–1991) was a British accountant and insolvency expert, and the Lord Mayor of London from 1978–1979. He is best known for chairing a major review of UK insolvency law (whose report issued in 1982 is widely referred to as the Cork Report and led to the passing of the Insolvency Act 1986).

The principles of the Act were:

- Insolvency laws were the means by which the demands of commercial morality can be met, through the investigation and the disciplinary measures and restrictions imposed on the bankrupt.

- Insolvency laws were treated by the trading community as an instrument in the process of debt recovery and constitute in many cases, the sanction of last resort for the enforcement of obligations. Insolvency laws were the means by which the demands of commercial morality can be met, through the investigation and the disciplinary measures and restrictions imposed on the bankrupt.

Rescue Culture

The central argument of the report was that too many companies were simply left to die when they could be revived, saved or brought to a close in a more orderly way.

Cork advocated that the law should encourage a “rescue culture” to restore companies back to profitability, which would be in the long-term benefit to the interests of creditors.

Floating charges

It also said there was no place for automatic crystallisation of floating charges ‘in modern insolvency law’, on the basis that it would adversely affect other creditors and that the charge did not need to be registered.

Professional regulation

Cork recommended that private insolvency practitioners should be professionally regulated to ensure adequate standards of competence and integrity. Creditors are given a greater voice in the choice of the liquidator and new penalties and constraints being placed on errant directors. Cork also proposed reforms designed to increase the survival chances of firms in difficulties. He had informed the press, on the establishment of his committee that many more companies could be saved if outside administrators could be brought in.

Cork was a partner in Cork Gully, a well-known firm of insolvency practitioners (established in 1935 with his father, WH Cork, and Harry Gully) which in 1980 became part of Coopers & Lybrand. Cork was recognised as ‘the insolvency baron’ who had a dominant role in that field which set him apart from mainstream accountancy.

Prior to his election of Mayor, he had served as a sheriff of London for 1975-76.

Cork also contributed to the governance of the arts, as Vice Chairman of the Arts Council and Chairman of the Royal Shakespeare Company, and guiding other bodies including the Philharmonic Orchestra and the London Festival Ballet.

When Kevin enthusiastically started his stainless steel business, he was not aware of the Insolvency Act 1986, Cork, or his firm Coopers & Lybrand. Like many company directors today, they are also not aware of what the act legislates.

Since 1986, Kevin has experienced insolvency practitioner barons ‘up close and personal’ and can only describe their trade as purveyors of ‘insolvent abuse’!

As a businessman, Kevin refers to their trade as that of ‘corporate rape and corruption’ which can only be defined as ‘the abuse of entrusted power for personal gain’

After a successful first year of trading, March 1986 -1987, Kevin received a letter from his bankers, Nat West Bank PLC praising his first year’s trading results as excellent.

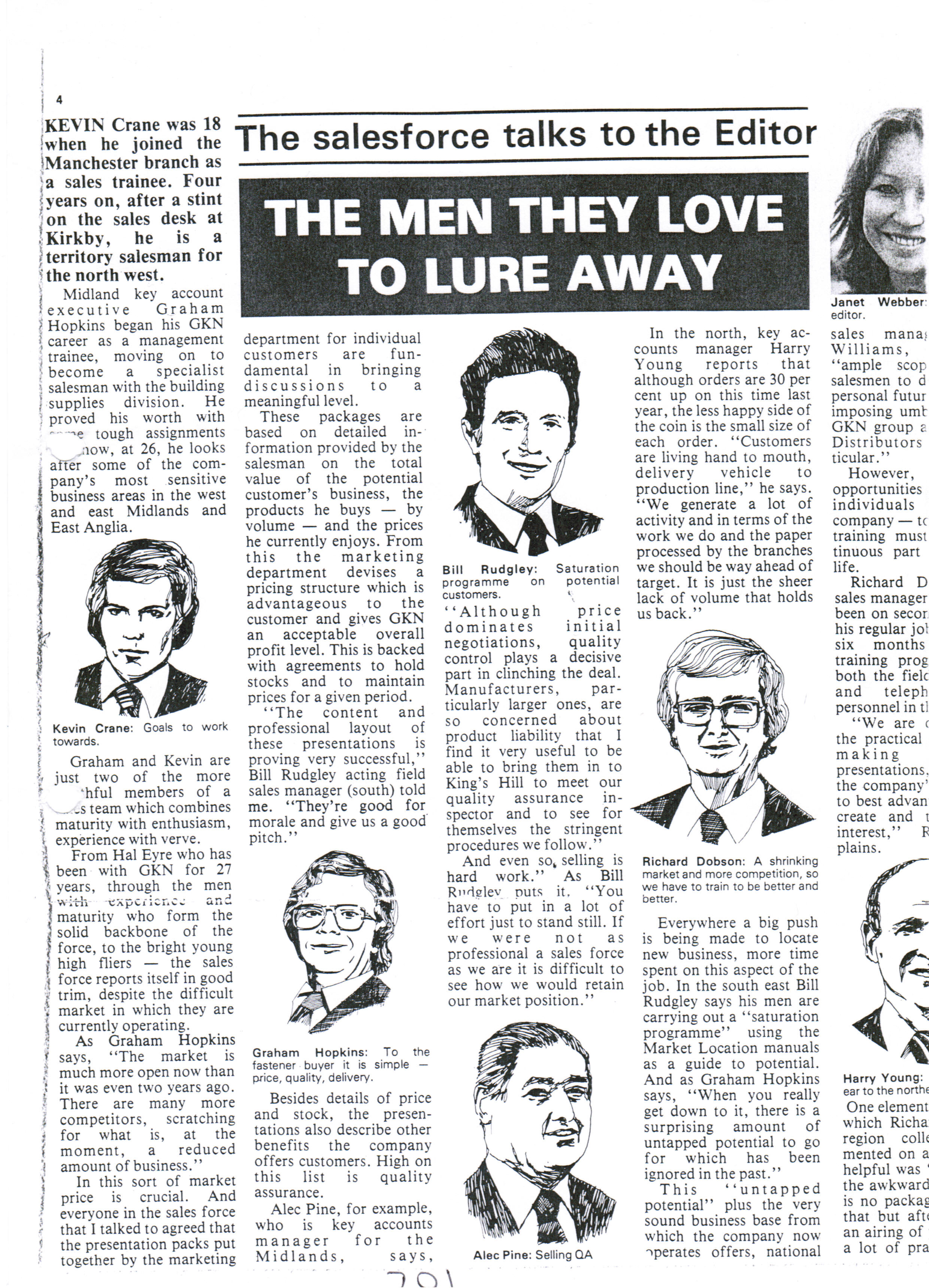

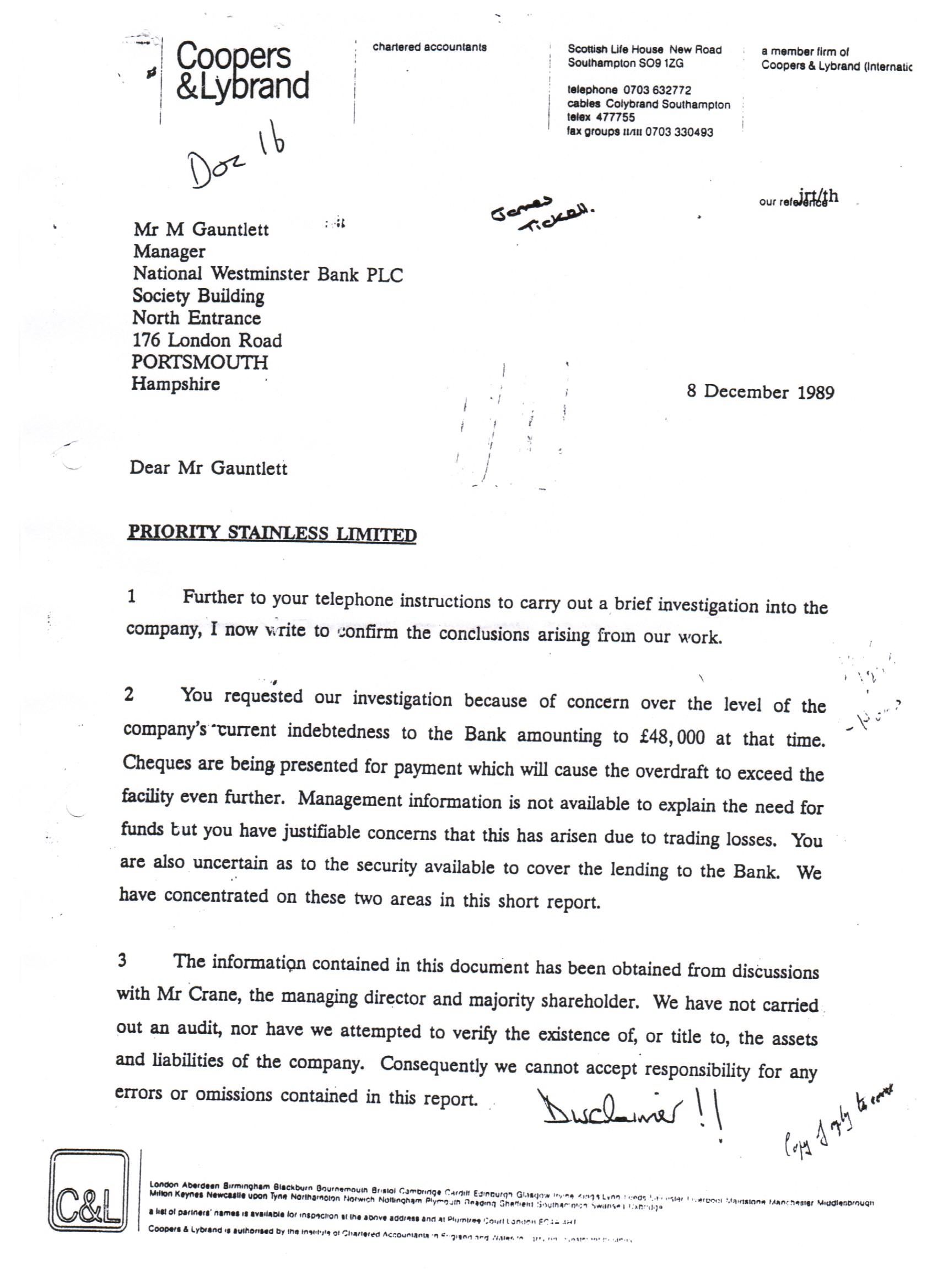

By contrast, in November 1989, an approach was made to the same bank for an overdraft facility of £20,000. This was to be used to buy stock following the award of a valued contract from Vosper Thorneycroft, a major UK Shipbuilder of minesweepers. A request for a viability report from the bank to Coopers Lybrand in support of the overdraft application resulted in a brief visit from a trainee accountant, Carl Jackson and his associate James Tickell. Their review of the business resulted in a very detailed report being submitted to the bank with an opening statement and as quoted, “This report is written without books or audit and we are therefore not liable for any error or omission contained within”.

A letter from Venture Factors dated October 1989 offers support to Kevin’s business contrary to the report of Coopers & Lybrand.

The Coopers & Lybrand report forced the company into liquidation within one month of the report’s recommendations. Conflictingly, the report proposed the fees for Coopers & Lybrand for executing a liquidation, totalling £7,000 contrary to the ‘rescue culture’ as advocated by Cork. The conflict of interest is clear for the insolvency barons and it is not about business rescue or recovery, it is about the demise and closure of businesses for profit as funded by support from the insolvency service and creditors unpaid debts

The instigator of the report at Coopers & Lybrand, James Tickell, who signed off the report is now a director of the Portland Group, Insolvency Practitioners of Whiteley, Hampshire and Carl Jackson his former trainee at Coopers & Lybrand in 1989 is now head of corporate recovery in the Tenon group.

Jackson was clearly well trained as an insolvency baron as the following article only confirms Kevin’s claims that insolvent abuse is common in the UK and transparent:

RSM Tenon recovery chief fined £5,000 by ICAEW

by Kevin Reed – Accountancy Age

09 Aug 2010

RSM Tenon head of recovery Carl Jackson has been fined £5,000 and paid costs of £83,557 after admitting that he failed to collect £330,000 as liquidator of a failed company, an ICAEW disciplinary tribunal found.

The tribunal said that Jackson, of Eastleigh, Hampshire, had failed to collect £330,000 from an agent on behalf of the liquidated company’s creditors; and that he had failed to make a full and proper disclosure to the creditors about the problems he had gaining access to the funds.

The debt-collecting agent received £330,000 from former directors of a liquidated company on behalf of Jackson as liquidator, for its creditors. The funds, however, were placed into the agent’s bank account in Monaco, rather than the account of Jackson’s solicitors.

Jackson was unable to pass any of the funds to creditors because they were being held by the agent in Monaco. The tribunal found that Jackson had failed to adequately record or evidence the terms of engagement with the agent. Read more: http://www.accountancyage.com/aa/news/1807789/rsm-tenon-recovery-chief-fined-gbp5-icaew#ixzz29UhMHmJX

Accountancy Age – Finance, business and accountancy news, features and resources.

Kevin continued to trade his business after 1989, maintaining his existing customer base through his consultancy company, Priority Marketing Ltd and during this time Kevin’s company staged successful engineering exhibitions known as ‘Primec’,

The ‘Priority Engineering Exhibitions, were very successful and sold out year on year, 1989 to 1990 with a throughput of 4,000 visitors over two days per exhibition staged.

Nat West exhibited showing their support for the success of ‘Primec’

In June 1992, Priority Stainless (UK) Ltd commenced trading and Kevin’s story, ‘A Bridge too far’ is detailed on the ‘Askevin’ page of this website.

In August 1997 and after an introduction to a firm of insolvency barons, Parker Wood of Stanmore Middlesex by a fellow businessman, Ray Kennedy; Parker Wood recommended they sell Kevin’s business to Ray Kennedy of Advanced Metals International Ltd of Watford, an aerospace and specialist metal’s company.

An intense vindictive and vicious campaign by Julian Wood followed to protect his firm’s conspiracy to defraud Kevin of his business. His associate in this crime was Raymond Dudley Kennedy!

Julian Wood a partner in his firm fled the UK for Israel, knowing he had perverted the course of justice with the CPS and the DTI. Although a partner in his firm, Wood was not an accountant or an insolvency baron. However, at all times he claimed to be an insolvency practitioner and passing off as such is a criminal offence. He was only qualified as a Chartered Secretary. He resigned from this institute in 2005. Why?

The ongoing saga of insolvent abuse continues, and whilst the abusers can run, they cannot hide! Whilst their every deed has a motive, often greed, the highest law in the land is truth and the truth of injustice is the purpose of this website for transparency and in the public interest! Publicity is the best disinfectant and to highlight this, reference is made to the news article as posted on this website on the news page with regard to ‘insolvent abuse’ in Australia and as exposed by the Senate ruling in clamping down on rogue insolvency barons.

Conspiracy to defraud is the trademark of the insolvency barons and the successor firm of Priority Stainless (UK) Ltd, relates to Priority Metals & Fasteners Ltd, July 1997 to November 2008. The Managing Director, Raymond Kennedy approached Mercer & Hole, insolvency barons of St Albans Hertfordshire. They allowed Kennedy to sell his business to another firm of which Kennedy was a director, Smiths Metal, for a considerable undervalue to the detriment of creditors. Leaving creditors out of pocket to the value of £500,000, the insolvency barons Mercer & Hole were sacked by the company’s creditors who appointed their own ‘forensic’ insolvency barons the Portland Group as headed by the partner, James Tickell, formerly Coopers & Lybrand and Carl Faulds the current Chairman of the Insolvency Practitioners Association and a former employee of the local official receiver from Southampton.

Representing the creditor’s committee, the Portland Group approached the sacked administrators Mercer & Hole for the £170,000 of payments collected from Priority Metals & Fastener’s customers whilst in administration. Court action was threatened after Mercer & Hole demanded their own fees first coincidently amounting to £170,000 for three months work for executing a failed, negligent and transparent fast-track, pre-pack deal to the detriment of all creditors including Kevin Crane.

Mercer & Hole threatened to hold the creditor’s committee personally accountable for their fees if a settlement could not be reached in their favour? An offer by Mercer & Hole to accept a reduced sum of £70,000 on ‘commercial grounds’ was rejected by the creditor’s committee, so in response, Mercer & Hole pursued the full amount with the threat of court action to pay their inflated fees.

The creditors of Priority Metals & Fasteners Ltd received nothing! This is another ‘prima facie’ case of ‘insolvent abuse’ contrary to the rescue culture as advocated by Cork in recommending the Insolvency Act 1986. This is not a rescue culture, it is a toxic culture and yet another example of ‘insolvent abuse’ and corruption that exists for personal gain and clearly, there is a conflict of interest to the detriment of creditors of defrauded companies.

We have seen what happened at Portsmouth Football Club, (in administration) where the appointed insolvency baron, Trevor Birch on behalf of his firm PKF (administrator) has charged £1 million for his services between February 2012 and September 2012 as he battled to save the company from financial meltdown. False accounting is clearly a criminal offence to the detriment of all creditors of any company in administration, but this is the UK, where it is allowed and not Australia where it is banned?

As a result of the Insolvency Act 1986, insolvency barons in their role as liquidators and administrators have the power to disqualify company directors. Currently, there are some twelve-thousand businessmen and women banned from being company directors and their names and addresses along with their dates of birth are posted on the Companies House website in Cardiff. It is a rogue’s gallery of individuals posted there to be exposed and to protect the public from these individuals who have lost their business and their livelihood and banned for a period of time of between two and fifteen years depending on the severity of the offence as alleged by the fee earning insolvency baron.

Please click on the weblinks page for more information.

Insolvency barons have the power to issue a ‘D’ report to the Secretary of State to recommend the disqualification of the director. The Secretary of State instructs the ‘Insolvency Services’ lawyers to prosecute and the director will have to defend the application to disqualify. This can cost directors in excess of £20,000 to defend and in most cases, the prosecution is heavily weighted against the accused. Good insolvency lawyers are few in number and have often worked for the Government’s Insolvency Service as disqualification is complex, specialist and protected by design.

Again we have a conflict of interest for profit and yet another example of insolvent abuse and corruption for profit and fee earning through disqualification proceedings?

The Government spends in excess of £30 million every year of taxpayer’s money to ensure prosecutions take place in in the Companies Court in the High Court London and is promoted as being in the public interest. This waste of public money could be put to better use such as prevention of disqualification instead of lining the pockets of rogue insolvency barons and lawyers? We are the only country in the world that prosecutes company directors for failure as recommended by insolvency barons in their ‘D’ reports.

Let us follow the lead as set by Australia and clean up this toxic insolvency culture.

Success is often defined as 99% failure and the only time success comes before work is found in the English dictionary!

To appreciate the insolvency industry, you have to understand the insolvency industry but insolvency barons would not advocate this. Sir Kenneth Cork has a lot to account for and so does the industry that is self-regulating as advocated by the former insolvency baron and his legacy? What a Pandora’s Box once opened?

‘Dear insolvency practitioner’, please clean up your 1986 Act

This website was inspired by Kevin’s encounter with Julian Harris Wood of Parker Wood and ‘Raymond Dudley Kennedy’ and his Spanish wife ‘Maria Angeles Kennedy’, fraudsters of Advanced Metals International Ltd, who conspired to defraud Kevin Crane of his business in June 1997 to 2018 as amended. In pursuit of justice, Kevin wishes to make it known that whilst being wrongly banned as a company director from 2001 to 2007 as recommended by a rogue insolvency baron; Kevin has never been made bankrupt or executed an IVA. His campaign for ‘justice’ is to overturn ‘injustice’ and that is his target, however long it takes? His case is now with the ‘Criminal Case Review Commission and is under review. To triumph over adversity, Kevin has had to improvise, adapt and overcome considerable bureaucracy and corridors of power and of course the ‘con-artists’ who will be held to account and exposed in due course!

(c) Kevin Crane 2021 (as amended)

ASKevin! – Contact Kevin for further information on 07769 316316 or email kevin.crane@yahoo.co.uk